Apple Pay has arrived in Canada

Woke up to the news this morning that Apple Pay has finally arrived in Canada. Exciting times, although the whole process took a lot longer than it should have, in my ever-so-humble opinion.

To be clear, I’ve been using Apple Pay since March, 2015, courtesy of having a U.S.-based TD Bank account, as part of TD Canada Trust’s Cross-Border Banking program. TD Bank added Apple Pay support to their credit and debit cards in late 2014, although I didn’t think of getting around to activating mine until a couple of months later. What was amazing about the whole process back then, however, is how well it all worked out. Apple Pay is basically just NFC contactless payments under the hood, so it uses the same technology as VISA PayWave and MasterCard PayPass physical cards, so every one of the millions of contactless payment terminals in Canada were ready for my U.S. based TD VISA Debit card from day one. Apple Pay coming to Canada was always more about the banks than the merchants.

The U.S. card experience

That said, the experience of using a U.S. based VISA Debit card wasn’t without its hiccups, even aside from dealing with CAD-USD exchange rates, but these were mostly just differences in how the banking and merchant systems are handled between the two countries.

The most common limitations I ran into is the fact that since NFC card payments aren’t really a big thing in the U.S.1, there actually aren’t any limits on contactless payments established by the card providers. Unfortunately, Candian point-of-sale systems don’t exactly know what to do about this, resulting in odd behaviour at times. While transactions under $100 (the usual ceiling limit here) were always fine, transactions over that often confused the terminals a bit, and sometimes the cashiers even more. In most cases, the terminals would just spit out a “signature required” slip, which I’d basically shrug off and sign without any fuss. Cashiers would sometimes tell me I can’t use tap to pay for larger amounts, but this is Canada, so they usually didn’t argue with me when I told them it was okay, and then proceeded to demonstrate exactly that.

In fact, the only really odd limitation I ever ran into was at the LCBO2, which for some reason had programmed their point-of-sale terminals to simply turn OFF the tap-to-pay feature if the transaction amount exceeded $100. While I can understand the logic of this — it’s easier to prevent the user from even trying to tap for larger transactions than to have to cancel and start over when it fails — it obviously also preventing me from even trying, despite my U.S. based card having no such limitations.

Beyond that, the only real limitation I ran into was a purely branding one, and not specific to Apple Pay. Certain stores I regularly shopped at — namely No Frills and Costco — only accept MasterCard, and my card was a VISA. So I couldn’t use Apple Pay at those stores, but not merely because it was Apple Pay.

Enter AMEX

Apple Pay first launced in Canada last November with American Express, following rumours that the banks would also be on board — TD Canada Trust even launched an Apple Pay web page that was quickly pulled. The common belief was that Apple was in negotiations with the major banks, but couldn’t come to terms, and that after negotiations stalled Apple simply went with AMEX both to be able to officially announce an expansion into Canada, as well as perhaps to put pressure on the banks.

Either way, I wasn’t going to switch to an AMEX card just for Apple Pay, for several reasons, but I heard numerous reports from those who had. For the most part, it seemed like a smooth launch, although there were some odd bumps in the road due to AMEX’s contactless systems not being quite as universal as VISA PayWave and MasterCard PayPass. Basically, reports came in that many merchants didn’t have terminals that were enabled by AMEX for tap-to-pay, and if an AMEX card coudln’t be used in this way, neither could an Apple Pay AMEX card.

VISA, MasterCard, and Interac all join the party

Today’s announcement, however, greatly expands the playing field. While the only banks that are on board at this point are RBC and CIBC, the others likely won’t be far behind — reports are suggesting mid-June. The Big 6 Banks up here pretty much move in lockstep with each other when it comes to major features like this, and it seems unlikely that the other four will be left behind by RBC and CIBC. Whether the reasons have to do with rate negotiations with Apple or technical implementation issues is unclear, however, although an unconfirmed report suggests that some of the other banks may have been looking for tighter integration into their iOS apps.

In addition to the banks, Canadian Tire MasterCard is also on board, although other bank-independent cards like Capital One remain out for now, with no timelines announced. Similarly, the “discount” banks like PC Financial and Tangerine aren’t yet supported. The former is owned by CIBC, which did announce support today, so it’s unclear what the timeline on that one will be. Tangerine, being owned by Scotiabank, may come on board when its parent bank does, or may remain in the same limbo as PC Financial.

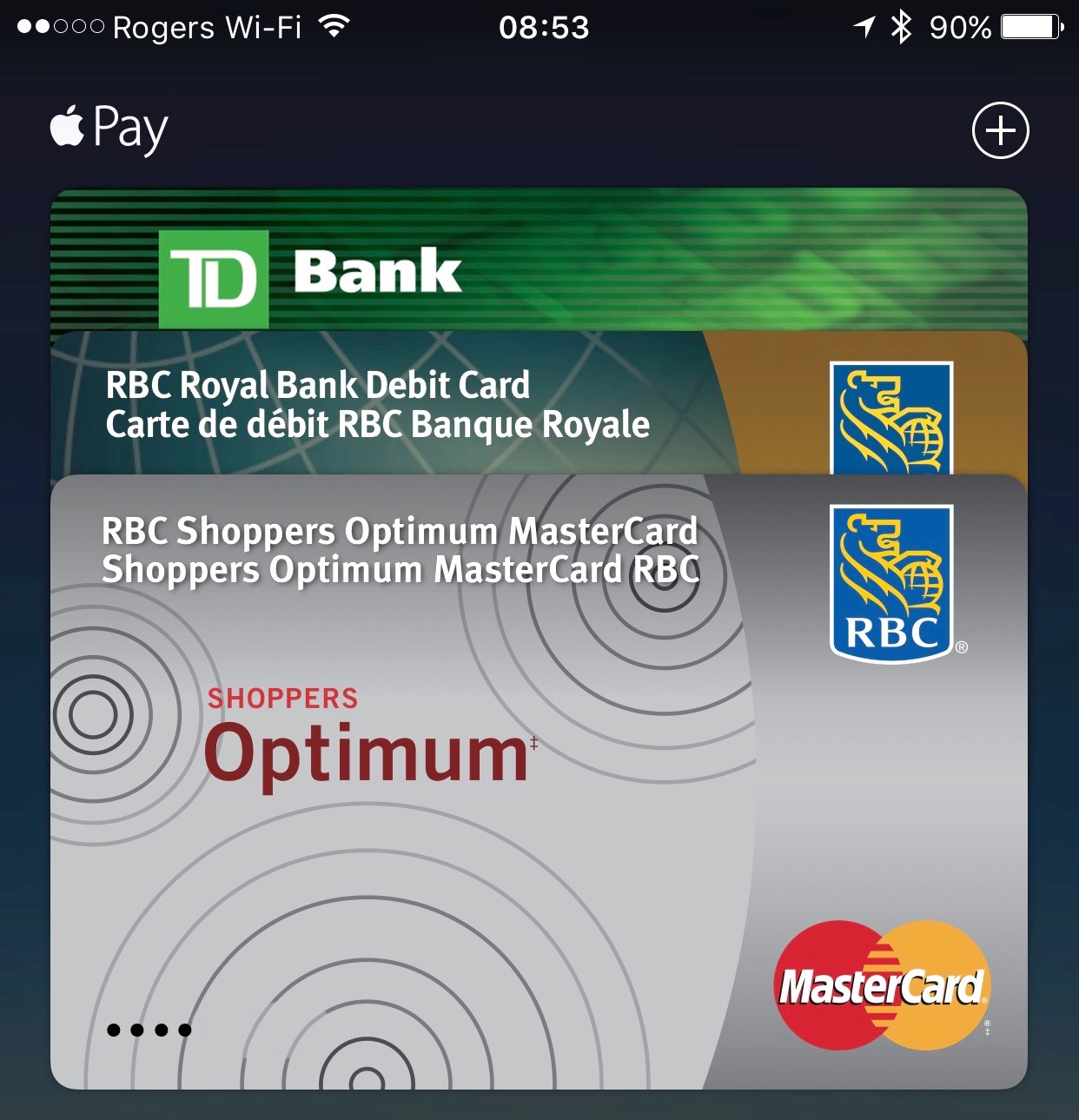

Adding my cards

I was able to successfully add my RBC MasterCard and RBC Interac card to the mix first thing yesterday morning, and it’s all been working pretty much as I’d expect. The RBC cards want to authenticate through RBC’s “Wallet” iOS app, which is a smoother process than having to actually call the bank. I didn’t originally have the RBC Wallet app installed, so the Apple Pay process linked me to the App Store instead of the app for the first card I added, and after I installed it, opened it, and logged in, the addition went through without any problems. The Client Card failed on the first attempt, but that seemed like more of a network timeout than anything else, and it worked after tapping “Try Again.”

Adding the cards to the Apple Watch was a separate process3, once again requiring authentication thorugh the Apple Watch, but it was a quick trip back into the RBC Wallet app to do this, made even easier by the fact that the app supports Touch ID.

I have yet to have any reason to go out and use these cards yet, but based on my Apple Pay experiences thus far with my U.S. card, I’m really not anticipating any problems, and it will be nice to have a MasterCard and Interac debit card in my digital wallet now for those places that don’t take VISA.

The future

Other than adding support for more banks and credit cards, I suspect the other limitation that Apple Pay will need to overcome here in Canada is raising the transaction limits that have traditionally been in place in Canada. As I noted earlier, the U.S. has no such limits in most cases, likely for the sole reason that NFC cards were never a big enough thing down there. Here in Canada, it’s logical to have a ceiling limit for a transaction method that doesn’t require a signature or a PIN — if somebody steals your credit or debit card, they can only make small purchases (usually under $100) unless they also have your PIN. Obviously, TouchID is even better than a PIN for security, but the NFC terminals presently in use have no way of knowing this.

While none of the banks have said anything thus far, it seems likely that this will mirror the situation in the U.K., where transactions have been limited to £20 for standard contactless terminals that haven’t yet been updated to newer standards. According to an Apple Support Document, terminals will need to support the Consumer Device Cardholder Verification Method before users will be able to take advantage of higher limits. Whether the Canadian banks will be on board with this remains to be seen. For now, at least, it looks like anybody in Canada expecting to make large purchases will need to ensure that they bring the appropriate plastic card along with them.

-

One report I read last year suggested that about 2% of U.S. merchants had any contactless payment support. I suspect the number in Canada is closer to the opposite end of that, with probably well over 90% of merchants supporting it. ↩

-

Ontario’s government-run liquor store chain ↩

-

Despite the cards being added from the iPhone, the Apple Watch is treated as a separate device, and the cards need to be validated in the same way as they would on an entirely different iPhone. The Apple Watch versions even get their own unique virtual card numbers, so you’ll be able to tell later from your receipts which device you paid with. ↩